child tax credit september 2021 late

Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Payments will start going out on September 15.

Child Tax Credit Delayed How To Track Your November Payment Marca

Families with kids under the age of six will receive 300 per child.

. To reconcile advance payments on your 2021 return. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit. The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus for kids under.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. More than 30million households are set to receive the payments worth up to 300 per child starting September 15. For families who received their first payment in September it may have been a larger amount of.

15 Worst States To Live on Just a Social Security Check The tax credit will phase out at a rate of 20 per. News Business Child tax credit payments for September are missing for some. September 14 2021 at 1035 am.

Get your advance payments total and number of qualifying children in your online account. How To Borrow Money on Cash App More. Enter your information on Schedule 8812 Form.

The only caveat to this is if you and your childs other parent dont live. And late Friday the Internal Revenue Service acknowledged that a group of people are facing roadblocks. The Child Tax Credit does not affect your other Federal benefits.

Parents should have received the most recent check from the IRS last week for up to 300 per child. But the IRS did not detail what went wrong or. 205 per qualifying child.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Congress fails to renew the advance Child Tax Credit. Why some Child Tax Credit payments are late or less than expected.

Missing your September child tax credit payment. The next round of Child Tax Credit advance payments are set to hit bank accounts on October 15. The IRS has confirmed that an issue is causing late payments.

I recieved 157 this afternoon via Direct Deposit a week late and only for 157 instead of 250. Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the advance child tax credit. Having received monthly Child Tax Credit payments in 2021 and any refund you receive as a result of claiming the Child Tax Credit is not considered income for any family.

The remaining money will come in one lump with tax refunds in 2021. Those with kids between ages six and 17 will get 250 for every child. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 3000 for children ages 6 through 17 at the end of 2021.

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. For families who are signed up each payment is up to 300 per month for each child under age 6 and up to 250 per month for. Its not too late you can still file your tax return to get the Child Tax Credit and thousands of dollars of additional tax benefits.

It doesnt matter if they were born on January 1 at 1201 am. Qualifying child is defined by section 24 c of the Internal Revenue Code. 3600 for children ages 5 and under at the end of 2021.

Is to blame for some people not receiving the September installment of the child tax credit. To get the full benefit single taxpayers. Child Tax Credit Norm Elrod.

Families who received monthly payments in the second half of last year can still get up to 1800 for children younger than 6 and 1500. The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4. Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son to land in his account by direct deposit on.

This will allow new parents with a baby born in 2021 to take advantage of the. CBS Detroit The third round of Child Tax Credit payments from. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. Child tax credit payments from September are finally hitting bank accounts as the IRS makes a new round of deposits on Friday. 2023 5 to 30 of the federal credit for each qualifying child depends on income and filing status Only available for children under age 6.

September 18 2021 1128 AM 6 min read. Or December 31 at 1159 pm if your child was born in the US. The Biden administration is beginning to distribute expanded child tax credit payments giving parents on average 423 this month with payments continuing through the end of the year.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. This isnt a problem to do.

What To Know About September Child Tax Credit Payments Forbes Advisor

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline

Child Tax Credit Dates As Irs Set To Send Out New Payments

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

September Birthstone Necklace Sapphire Teardrop Necklace Etsy

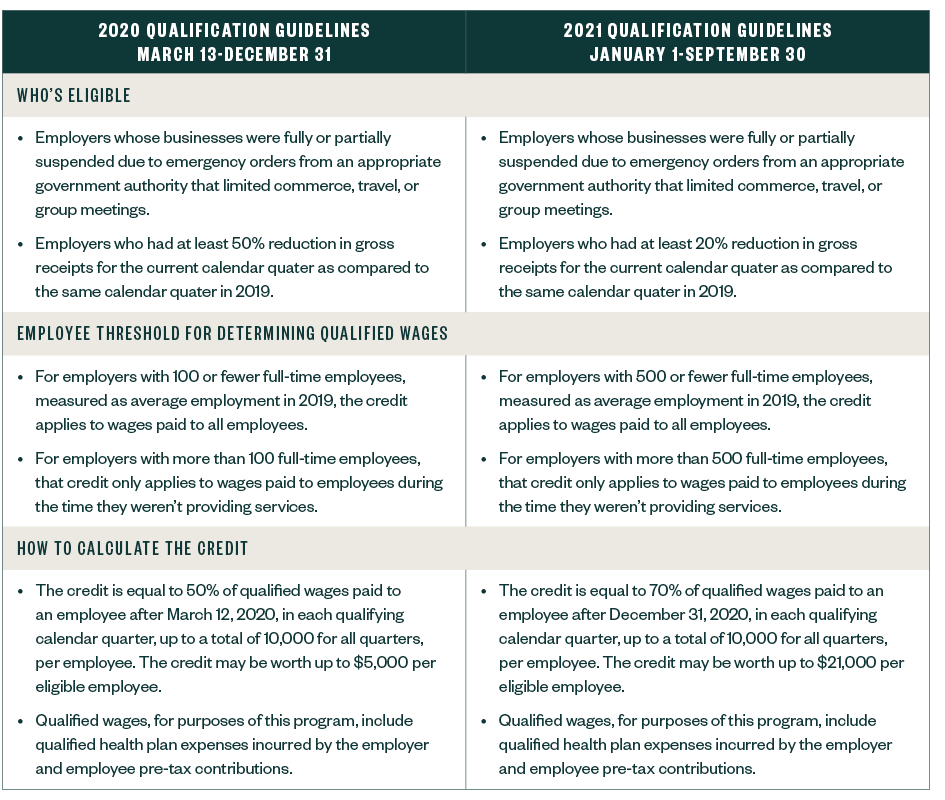

Deadline Extended To Claim The Employee Retention Tax Credit

Majority Of Voters Support The Build Back Better Act And Want It Passed Now

Child Tax Credit 2021 How To Track September Next Payment Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Delayed How To Track Your November Payment Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Claim Of Gst Itc Of Previous Year If September Gst Return Filed Late Wit Previous Year September Tax Credits

Missing A Child Tax Credit Payment Here S How To Track It Cnet